How Do Interest Rates Affect Bond Market . Bond duration is a measure of the degree to which a bond investment is likely to change in value if. when interest rates rise, bond values decrease. when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with higher yields. To those unfamiliar with bond trading,. If bond yields decline, the value of. bonds have an inverse relationship to interest rates. The impact, however, will vary according to each investor's individual circumstances. bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest rate risk.

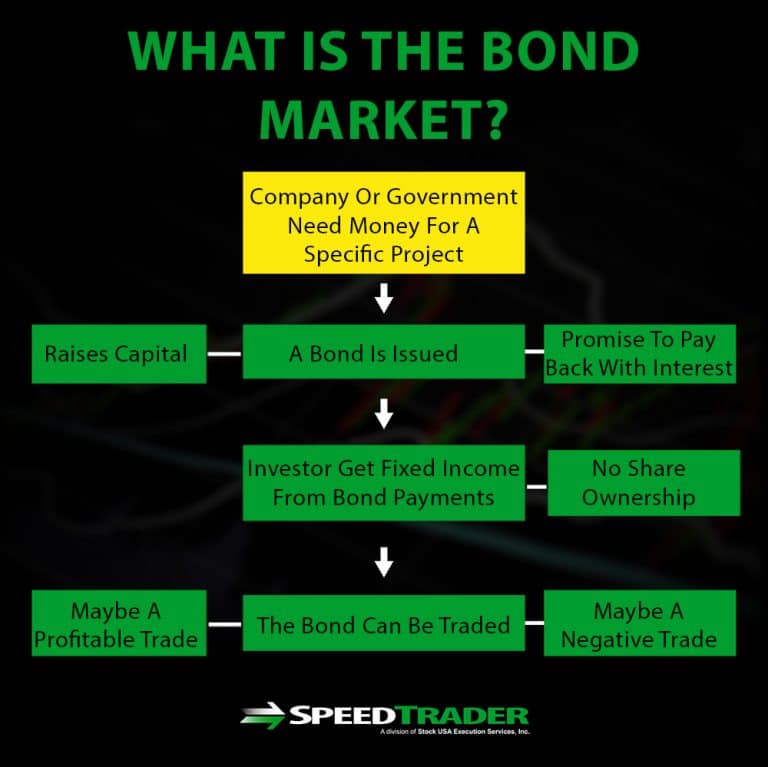

from speedtrader.com

bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest rate risk. bonds have an inverse relationship to interest rates. To those unfamiliar with bond trading,. when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with higher yields. when interest rates rise, bond values decrease. If bond yields decline, the value of. Bond duration is a measure of the degree to which a bond investment is likely to change in value if. The impact, however, will vary according to each investor's individual circumstances.

What You Need To Know About How Stock and Bond Markets Interact

How Do Interest Rates Affect Bond Market To those unfamiliar with bond trading,. when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with higher yields. The impact, however, will vary according to each investor's individual circumstances. when interest rates rise, bond values decrease. If bond yields decline, the value of. Bond duration is a measure of the degree to which a bond investment is likely to change in value if. To those unfamiliar with bond trading,. bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest rate risk. bonds have an inverse relationship to interest rates.

From oxfordclub.com

How Rate Changes Affect Bonds Differently The Oxford Club How Do Interest Rates Affect Bond Market Bond duration is a measure of the degree to which a bond investment is likely to change in value if. If bond yields decline, the value of. bonds have an inverse relationship to interest rates. when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with higher yields. bond. How Do Interest Rates Affect Bond Market.

From dxofyjrqe.blob.core.windows.net

How Do Interest Rates Impact Bond Yields at Lyle Devito blog How Do Interest Rates Affect Bond Market If bond yields decline, the value of. when interest rates rise, bond values decrease. bonds have an inverse relationship to interest rates. Bond duration is a measure of the degree to which a bond investment is likely to change in value if. To those unfamiliar with bond trading,. bond prices move in inverse fashion to interest rates,. How Do Interest Rates Affect Bond Market.

From open.lib.umn.edu

25.2 Demand, Supply, and Equilibrium in the Money Market Principles How Do Interest Rates Affect Bond Market bonds have an inverse relationship to interest rates. Bond duration is a measure of the degree to which a bond investment is likely to change in value if. when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with higher yields. If bond yields decline, the value of. when. How Do Interest Rates Affect Bond Market.

From www.slideserve.com

PPT Money Demand, the Equilibrium Interest Rate, and Policy How Do Interest Rates Affect Bond Market bonds have an inverse relationship to interest rates. To those unfamiliar with bond trading,. If bond yields decline, the value of. when interest rates rise, bond values decrease. Bond duration is a measure of the degree to which a bond investment is likely to change in value if. when interest rates rise, bond prices generally fall, making. How Do Interest Rates Affect Bond Market.

From www.slideserve.com

PPT Money Demand, the Equilibrium Interest Rate, and Policy How Do Interest Rates Affect Bond Market To those unfamiliar with bond trading,. The impact, however, will vary according to each investor's individual circumstances. If bond yields decline, the value of. when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with higher yields. Bond duration is a measure of the degree to which a bond investment is. How Do Interest Rates Affect Bond Market.

From goldenpi.com

How does Inflation Affect Bond price? Relationship Between Bond How Do Interest Rates Affect Bond Market The impact, however, will vary according to each investor's individual circumstances. Bond duration is a measure of the degree to which a bond investment is likely to change in value if. To those unfamiliar with bond trading,. bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest rate risk. when. How Do Interest Rates Affect Bond Market.

From www.bartleby.com

Draw both the money market and bond market in equilibrium. Next How Do Interest Rates Affect Bond Market when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with higher yields. bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest rate risk. when interest rates rise, bond values decrease. To those unfamiliar with bond trading,. The impact, however,. How Do Interest Rates Affect Bond Market.

From saylordotorg.github.io

Interest Rates and Capital How Do Interest Rates Affect Bond Market If bond yields decline, the value of. bonds have an inverse relationship to interest rates. bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest rate risk. when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with higher yields. Bond. How Do Interest Rates Affect Bond Market.

From speedtrader.com

What You Need To Know About How Stock and Bond Markets Interact How Do Interest Rates Affect Bond Market bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest rate risk. To those unfamiliar with bond trading,. bonds have an inverse relationship to interest rates. Bond duration is a measure of the degree to which a bond investment is likely to change in value if. If bond yields decline,. How Do Interest Rates Affect Bond Market.

From dxosyfjua.blob.core.windows.net

How Does The Interest Rate Affect Bonds at Hilda Bartlett blog How Do Interest Rates Affect Bond Market The impact, however, will vary according to each investor's individual circumstances. Bond duration is a measure of the degree to which a bond investment is likely to change in value if. when interest rates rise, bond values decrease. To those unfamiliar with bond trading,. when interest rates rise, bond prices generally fall, making existing bonds less attractive compared. How Do Interest Rates Affect Bond Market.

From financialdesignstudio.com

Managing Interest Rate Risk in your Bond Investments How Do Interest Rates Affect Bond Market bonds have an inverse relationship to interest rates. when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with higher yields. To those unfamiliar with bond trading,. when interest rates rise, bond values decrease. bond prices move in inverse fashion to interest rates, reflecting an important bond investing. How Do Interest Rates Affect Bond Market.

From darrowwealthmanagement.com

How Do Interest Rates Affect Bonds? Relationship Between Rates, Bond How Do Interest Rates Affect Bond Market when interest rates rise, bond values decrease. bonds have an inverse relationship to interest rates. bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest rate risk. Bond duration is a measure of the degree to which a bond investment is likely to change in value if. The impact,. How Do Interest Rates Affect Bond Market.

From us.etrade.com

Bonds, interest rates, and inflation Learn More E*TRADE How Do Interest Rates Affect Bond Market when interest rates rise, bond values decrease. Bond duration is a measure of the degree to which a bond investment is likely to change in value if. bonds have an inverse relationship to interest rates. when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with higher yields. . How Do Interest Rates Affect Bond Market.

From www.indexologyblog.com

Bonds in a Rising Interest Rate Environment Indexology® Blog S&P How Do Interest Rates Affect Bond Market bonds have an inverse relationship to interest rates. when interest rates rise, bond values decrease. To those unfamiliar with bond trading,. Bond duration is a measure of the degree to which a bond investment is likely to change in value if. when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly. How Do Interest Rates Affect Bond Market.

From www.smartstudyhelp.com

Using the loanable funds theory, show in a graph how the following How Do Interest Rates Affect Bond Market If bond yields decline, the value of. when interest rates rise, bond values decrease. Bond duration is a measure of the degree to which a bond investment is likely to change in value if. To those unfamiliar with bond trading,. bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest. How Do Interest Rates Affect Bond Market.

From www.researchgate.net

Bond, interest rate and inflation relationship Download Scientific How Do Interest Rates Affect Bond Market bonds have an inverse relationship to interest rates. bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest rate risk. To those unfamiliar with bond trading,. when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with higher yields. when. How Do Interest Rates Affect Bond Market.

From obliviousinvestor.com

Which Interest Rates Affect Bond Prices? — Oblivious Investor How Do Interest Rates Affect Bond Market If bond yields decline, the value of. bonds have an inverse relationship to interest rates. The impact, however, will vary according to each investor's individual circumstances. when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with higher yields. To those unfamiliar with bond trading,. bond prices move in. How Do Interest Rates Affect Bond Market.

From www.nationalmortgagenews.com

Average mortgage rates decline, at least for one week National How Do Interest Rates Affect Bond Market If bond yields decline, the value of. when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with higher yields. The impact, however, will vary according to each investor's individual circumstances. To those unfamiliar with bond trading,. bond prices move in inverse fashion to interest rates, reflecting an important bond. How Do Interest Rates Affect Bond Market.